Author:

Joele Novelli

Socials:

Twitter - Telegram - Youtube - LinkedIn - Instagram - Newsletter - TikTok

Introduction

Hello everyone

Today we are here to talk once again about onchain analytics.

For today's article I have chosen a couple of graphs that are aimed at the analysis of a possible onchain resistance deriving from a basic cost of some category of hodlers and in addition we will also talk about the forensic analysis related to the holding of BTC by of the American government, going into detail regarding the acquisition of data and the movement of BTC

You can find the full version of my thoughts on the matter on Twitter, in mine PODCAST

Or on

Today we are gonna talk about:

Young Cumulative Bands Realized Price

Isolated Age Bands Realized Price

Bitcoin held by the US GOV

But let's not waste any more time and immediately get into the merits of onchain analysis

Young Cumulative Bands Realized Price

We also talked about Young Cumulative Bands last time, but for those of you who are new, I'll go over the concept again

Young cumulative bands is an onchain metric that takes into account hodlers who have held the asset up to a certain period.

In this case we are talking about hodlers who have held the asset for a month or less, for 3 months or less, for 6 months or less, for a year or less and finally for 2 years or less, with the latter category taking into I also examine all the others of course

As far as the realized price is concerned, we are talking about the basic on-chain cost for each category of hodlers, which could turn into support or resistance as the price approaches from various directions.

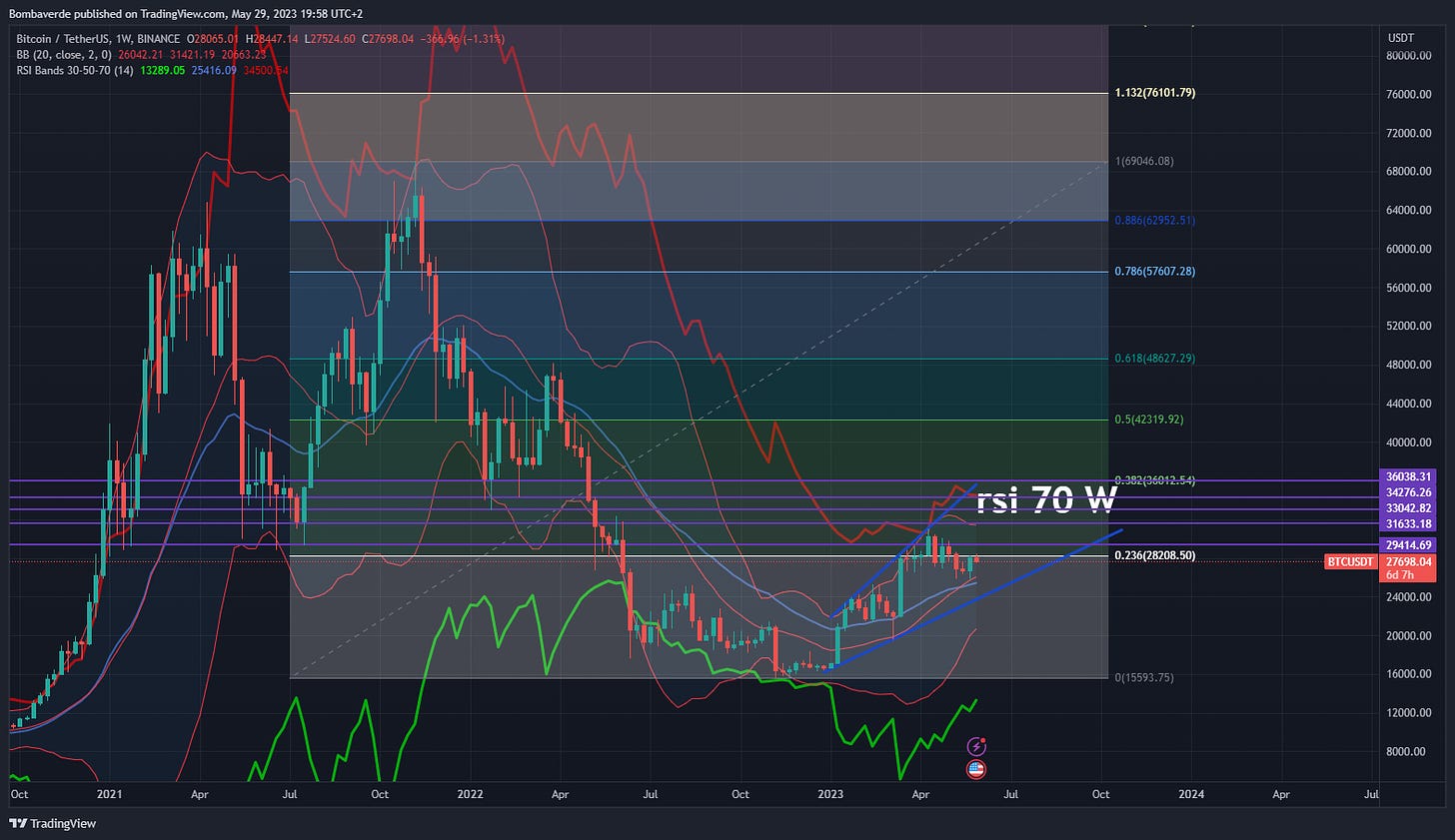

Here we can see that 29.5k is the realized price of Bitcoin holders for 2 years or less and that both in the first bear market rally and now this price range tends to act as resistance to Bitcoin.

Note that the same price range results from a technical analysis graph using the fibonacci (in the following image I have put the possible resistances on the graph, including those of the fibonacci, follow me on Youtube to stay updated also on the technical analysis side, since I started creating content dedicated to Italians once a week, on the weekend, and I make live streams on wednesday in english)

So everything coincides as a possible first resistance price range

Isolated Age Bands Realized Price

Isolated Age Bands, on the other hand, takes into consideration hodlers divided into isolated time bands, i.e. from one specific amount of time to another.

As far as the realized price is concerned, we are talking about the basic on-chain cost for each category of hodlers, which could turn into support or resistance as the price approaches from various directions.

Other price ranges realized are then the 36.8k of the holders from 2 to 3 years and the 42.8k of those from 1 to 2 years.

These same price ranges, as you can see, are considered by the previous technical analysis chart in more or less the same way

Beware of the 0.5 fib

But now let's get to the juicier onchain analytics part of today

Bitcoin held by the US GOV

Let's start here by citing the source, as it seems necessary and right to thank Dune Analytics for the forensic analysis carried out on the Bitcoins held by the US government, really congratulations to all the team, if anything, will have the honor of having one of them read this analysis.

Introduction to forensic analysis

Before starting, it is equally necessary to specify that the total Bitcoins currently held by the US government are impossible to identify as a whole and to know the destination that the traceable Bitcoins will take once the movement has begun

What we can know from verified sources and directly from the government website is that certain sums have been subjected to seizure, thanks to official documents traceable here:

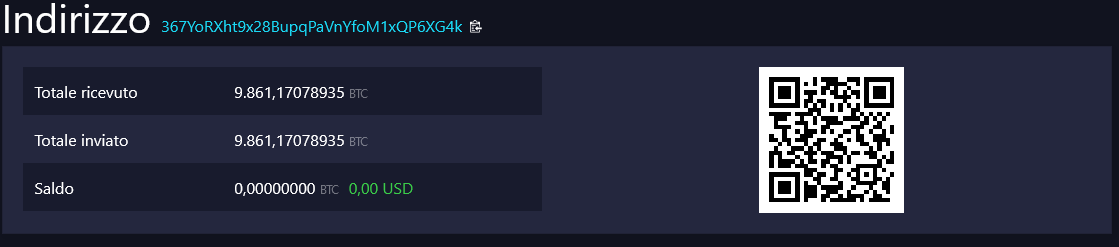

And that a certain amount, around 9.86k Bitcoins, have been transferred out of wallets possibly attributable to government authorities (since it probably won't be a single entity that will take care of the whole process of seizure, storage and resale on an auction basis of the Bitcoin in question), at least according to glassnode.

DIRECT SOURCE TO THE GLASSNODE’S ANALYSIS ON TWITTER

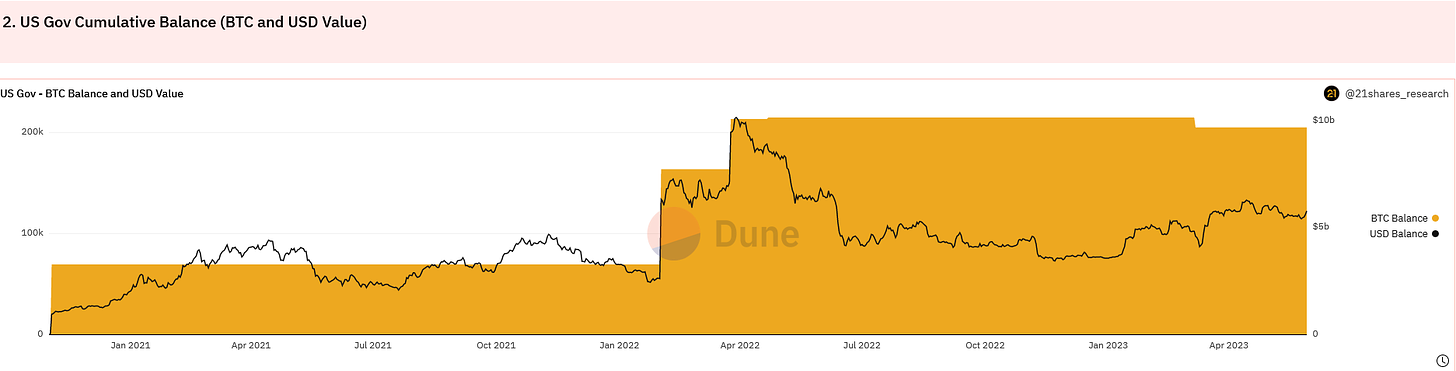

As you can see, today Bitcoin that are probably part of those held by the US government are about 205 thousand, for a value updated to March 7, 2023 of about 5.8 billion dollars, or about 1% of the total circulating supply of Bitcoin.

From the graph below we can then see how the amount of coins held changes over time thanks to the help of a graph that shows us BTC (orange part) and relative dollar value (black serrated line)

Here we have a pie chart of the last three seizures

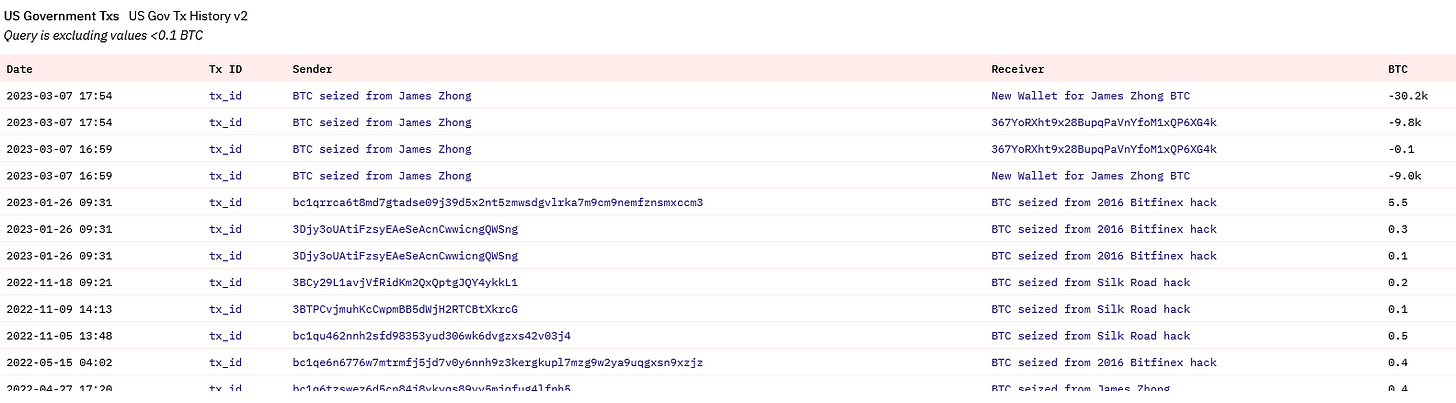

Below, as you can see, are the latest significant transactions from wallets associated with the US government, of which we will analyze the last one to let you understand directly how widely these widespread news about the sale of Bitcoins by the US government are for the most part. nonsense part.

The US government does not sell Bitcoin on exchanges, but through sponsored public auctions of which we know and whose buyers can be known if you participate.

And I would add that even if you saw the transaction before (which was directed towards coinbase anyway) this does not mean that they sold on the market, also because an estimate of 10k BTC at the average price of 20k dollars sold on the market would have brought down the price of at least 20% without counting stop losses taken and cascading falls, which instead resolved due to generalized fear only in a decrease of about 8% followed by about a 50% uptrend in the following 7 days.

The conclusions are up to you.

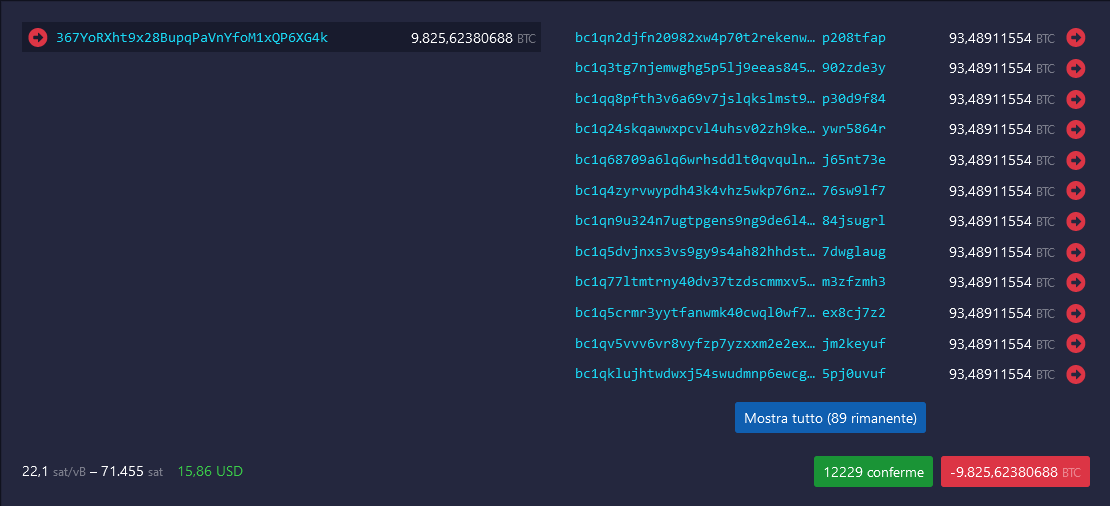

In any case, let's take the last 4 transactions that should be part of the BTC seized from James Zhong.

Below you see the transactions with the amount

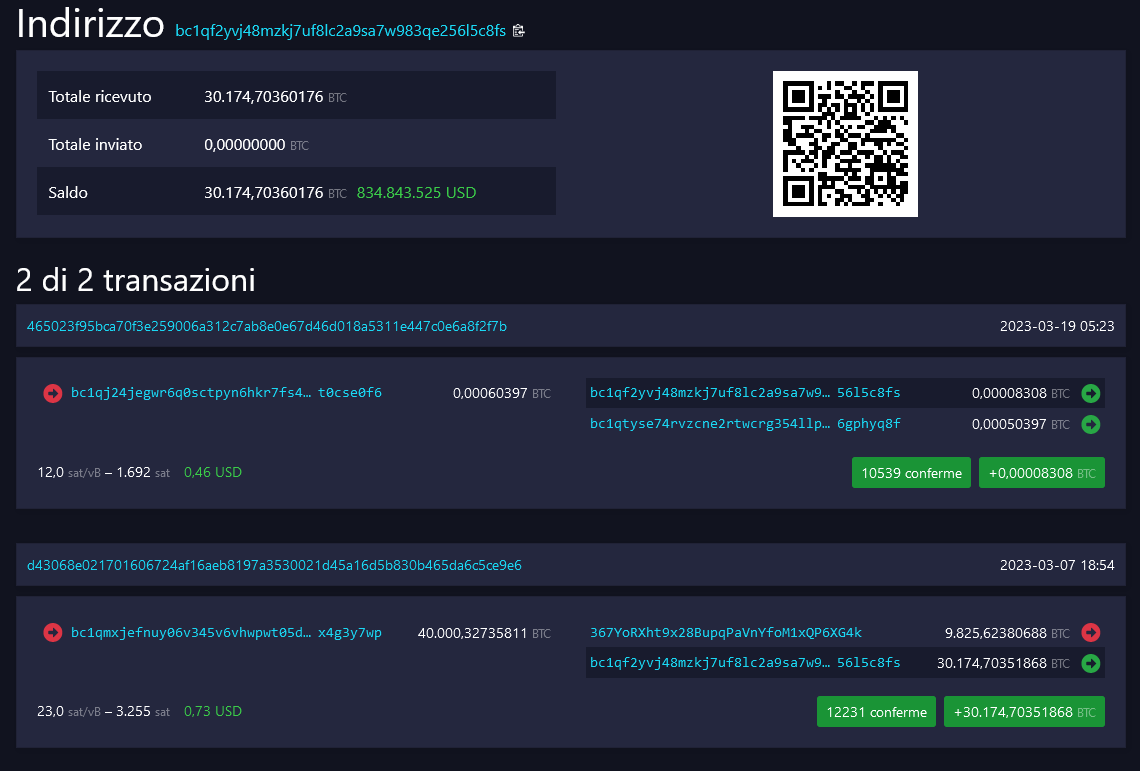

As you will notice in this case we have two transactions: from 30k which still remain in the wallet where wallets were sent

and 10k Bitcoins that were sent elsewhere, this would then be the transaction examined by glassnode

The latter is then further divided into 101 various other transactions of more or less similar value that end up in as many wallets, and figuring out where they all end up is quite difficult, but you can immediately understand how the approximately 10k not all of them were sold on the market, if anything some of them were

This once again shows us how news must be analyzed in detail before giving it a value and that many times it's not even worth it, logical reasoning is enough to eliminate any FUD from the list of problems of the day.

So a very friendly final tip: next time you hear about Bitcoin being sold by the US government, at least do a quick search for a public auction to silence those old sponges who want to blow Bitcoin out of your hands.

Author

Joele Novelli

Socials:

Twitter - Telegram - Youtube - LinkedIn - Instagram - Newsletter - TikTok

(Tutte le opinioni espresse sopra sono opinioni personali dell’autore e non dovrebbero costituire una base per prendere decisioni di investimento, né essere interpretate come una raccomandazione o un consiglio per impegnarsi in transazioni di investimento.)